Table of Contents

- What Will Trump’s Tariffs Mean For Businesses?

- Donald Trump vows to impose 25% tariff on products from Canada, Mexico

- Trump Plans Over 60% Tariffs on China If Elected | China In Focus - YouTube

- China, Mexico, Canada respond to Trump tariff threats

- Donald Trump's tariffs on Chinese imports will tax American consumers

- The Next Tariffs Round - Trump Slaps Import Duties on 0 Billion and ...

- Trump, US, China trade war: new tariffs in place, talks go nowhere ...

- Tariff Wars and Industrial Policy - Christopher A. McNally - CHINA US Focus

- China Tariffs

- Trump's tariffs on China: Who will pay? | DW News - YouTube

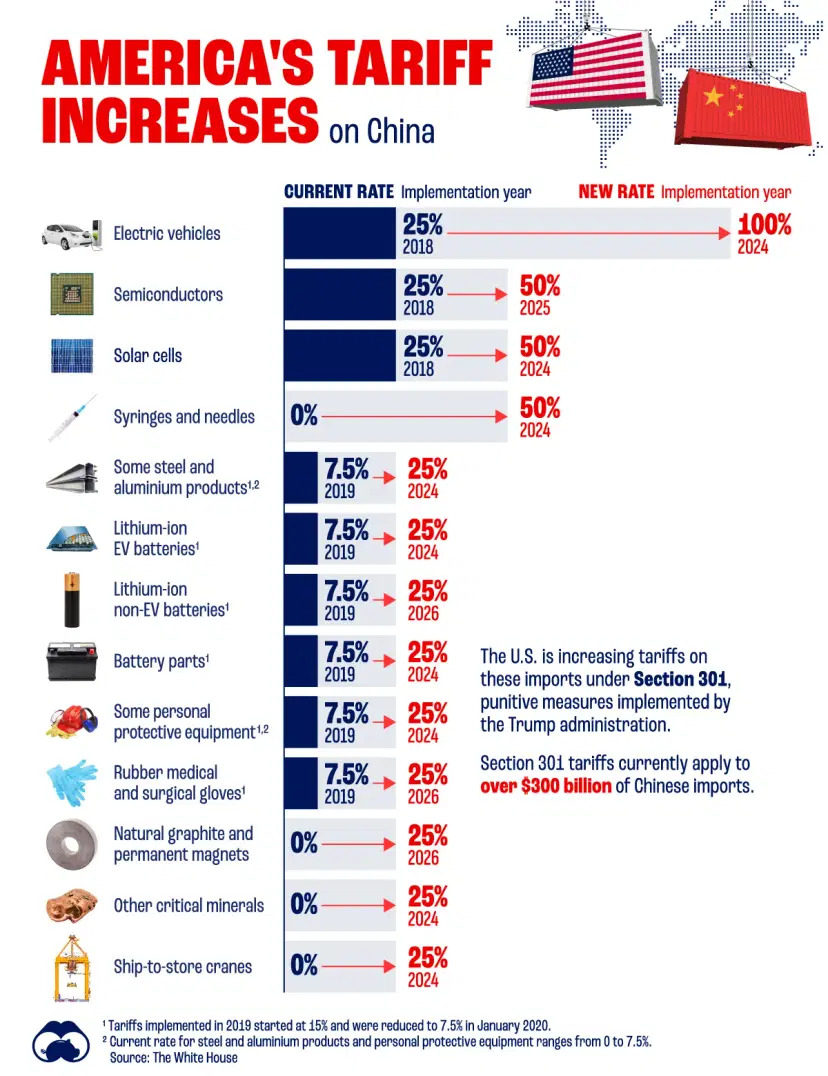

The trade war between the U.S. and China has been simmering for months, with both countries imposing tariffs on each other's goods. The latest escalation began when the U.S. raised tariffs on $200 billion worth of Chinese imports from 10% to 25%. China responded swiftly, announcing its decision to increase duties on $60 billion worth of U.S. goods. The retaliatory duties, which range from 5% to 25%, will be imposed on a wide range of U.S. products, including agricultural goods, chemicals, and industrial equipment.

Impact on the Global Economy

The trade war is also having a disproportionate impact on certain industries, such as agriculture and manufacturing. U.S. farmers, who have been a key supporter of President Trump, are being hit hard by the Chinese tariffs on agricultural goods. The tariffs have led to a significant decline in U.S. agricultural exports to China, which has resulted in financial losses for many farmers. Similarly, U.S. manufacturers are facing increased costs due to the tariffs on Chinese imports, which could lead to higher prices for consumers and reduced competitiveness in the global market.

What's Next?

The Trump administration has been under pressure to resolve the trade war, with many lawmakers and business leaders urging the President to negotiate a trade deal with China. However, the administration has shown no signs of backing down, with President Trump tweeting that the tariffs are "working big time" and that the U.S. is "in a great position". The Chinese government, on the other hand, has stated that it will not be intimidated by the U.S. tariffs and will continue to defend its economic interests.

The escalating trade war between the U.S. and China has significant implications for the global economy. The retaliatory duties imposed by China on U.S. goods are a clear indication that the trade war is far from over. As the situation continues to unfold, it is essential for businesses and investors to stay informed about the latest developments and to prepare for the potential consequences of the trade war. With the global economy at stake, it is crucial for the U.S. and China to negotiate a trade deal that benefits both countries and prevents further escalation.In conclusion, the trade war between the U.S. and China is a complex and multifaceted issue that requires a nuanced understanding of the economic and political factors at play. As the situation continues to evolve, it is essential to stay informed and to be prepared for the potential consequences of the trade war. By understanding the implications of the trade war and the potential outcomes, businesses and investors can make informed decisions and navigate the challenges posed by this ongoing economic conflict.