Table of Contents

- How to Buy Google Stock [2025] | Invest in GOOGL

- Google. - ppt download

- Google stock: overview, price, dividends

- Is Google (GOOG) Stock a Buy!? | Google Stock Analysis - YouTube

- GOOG Stock: Do Yourself a Favor and Get Past Alphabet’s Stock Split ...

- Alphabet Stock (NASDAQ:GOOGL): Is It Too Late to Buy after Post ...

- google stock price - Andrus.digital

- Alphabet Stock Analysis / Is GOOGL Stock Overvalued? - YouTube

- Google stock - AnaliseTymon

- Which stocks are trending today on Google? #Gold #News #Australia # ...

![How to Buy Google Stock [2025] | Invest in GOOGL](https://assets.finbold.com/uploads/2023/02/Google-Stock-1.jpg)

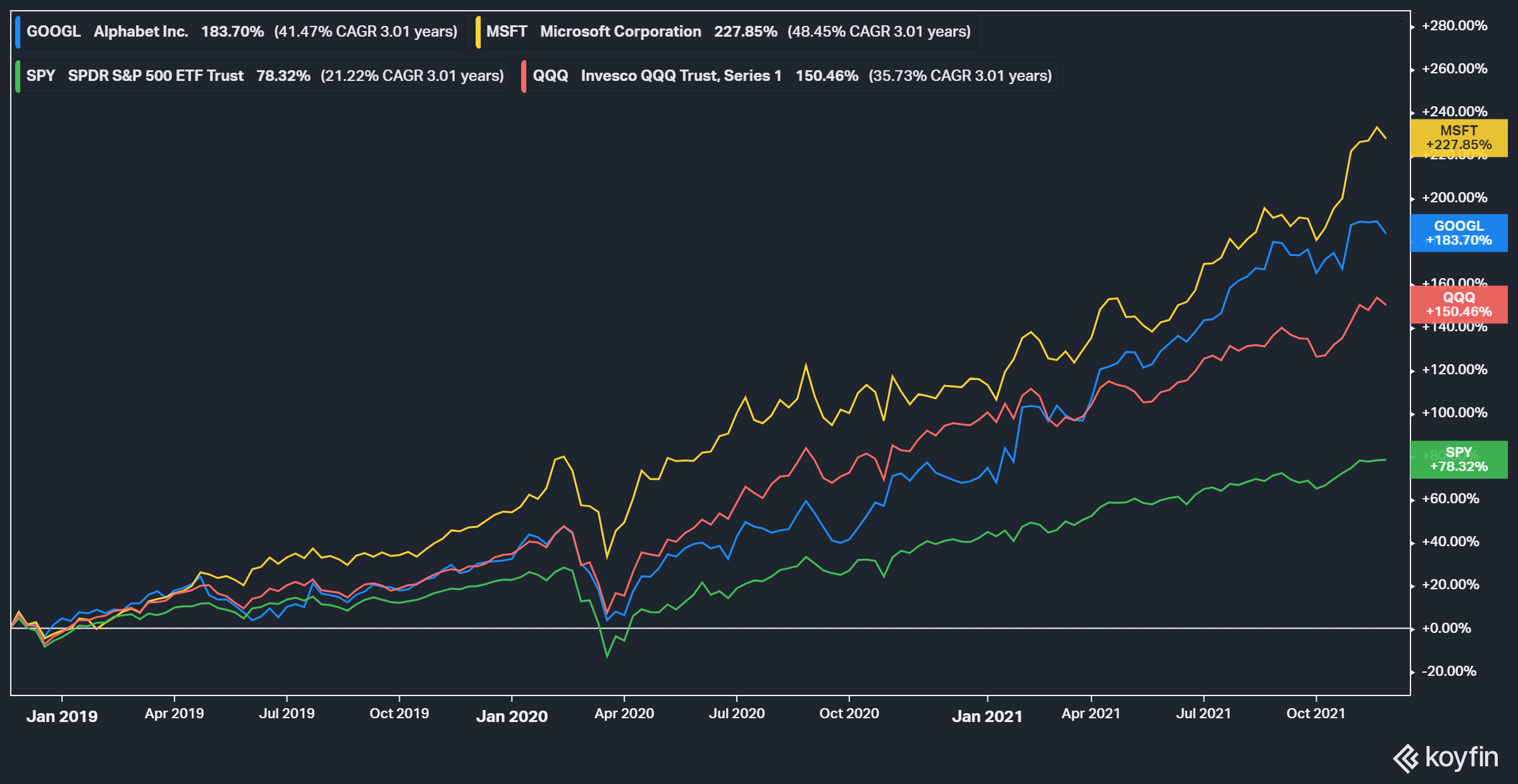

Current Stock Price and Trends

Financial Performance

Key Drivers of Growth

Several factors have contributed to Alphabet's growth and strong stock performance. Some of the key drivers include: Google Search and Advertising: Google's search engine and advertising business remains the company's largest revenue source, with a dominant market share. Cloud Computing: Alphabet's cloud business, Google Cloud, has been growing rapidly, with the company investing heavily in infrastructure and talent. Hardware and Devices: The company's hardware segment, including Pixel smartphones and Chromebooks, has also been performing well, with a growing market share. Artificial Intelligence and Emerging Technologies: Alphabet has been investing heavily in AI and emerging technologies, such as self-driving cars and life sciences, which are expected to drive future growth.

Challenges and Risks

While Alphabet Inc. has been performing well, there are several challenges and risks that investors should be aware of. These include: Regulatory Risks: The company faces regulatory risks, particularly in the areas of antitrust and data privacy. Competition: Alphabet faces intense competition in its core search and advertising business, as well as in emerging markets such as cloud computing. Economic Uncertainty: The company's performance can be impacted by economic uncertainty, including recession and trade tensions. In conclusion, Alphabet Inc. (GOOGL) stock has been performing well, driven by the company's strong financial performance and growth in emerging markets. While there are challenges and risks, the company's innovative products and services, as well as its strong brand and market position, make it an attractive investment opportunity. Investors should keep a close eye on the company's financial performance and industry trends to make informed investment decisions. As always, it's essential to do your own research and consult with a financial advisor before making any investment decisions.Source: Wall Street Journal (WSJ)