Table of Contents

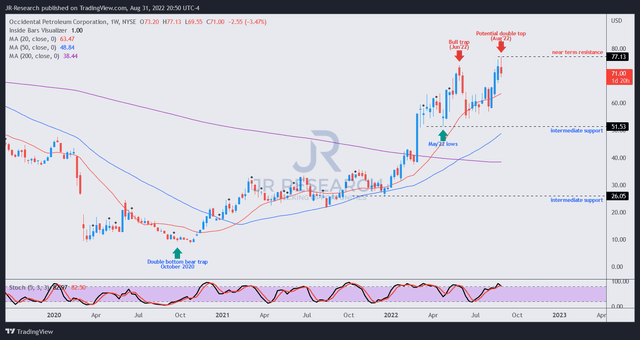

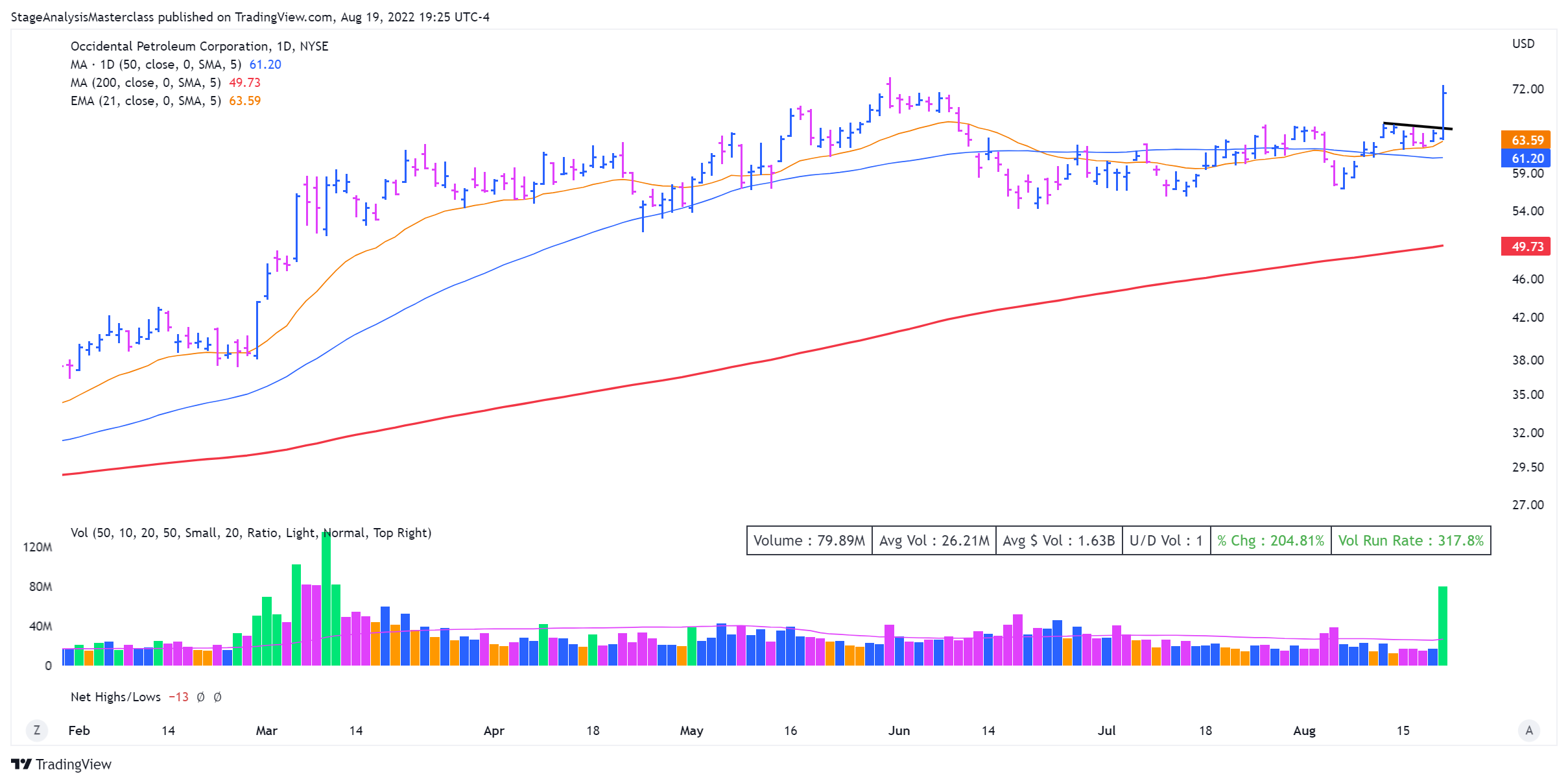

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- OXY Stock and Chart Analysis - by Richard Moglen

- OXY Stock Price Declines After Negative Surprise in Earnings: Guest ...

- Occidental Petroleum Corporation (OXY) Stock Price, News, Quote ...

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- Occidental Stock: Another Fantastic Selling Opportunity (NYSE:OXY ...

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- More OXY purchased - Stocks A to Z - Motley Fool Community

- Occidental Petroleum Corporation: Must Know Things for OXY Stock: Guest ...

- Occidental Petroleum Stock Quote. OXY - Stock Price, News, Charts ...

A Brief Overview of Occidental Petroleum (OXY)

Why OXY is Undervalued

Growth Drivers

Several factors are poised to drive growth for Occidental Petroleum: Increasing Oil Prices: Rising oil prices are expected to boost OXY's revenue and profitability, as the company's oil production is heavily weighted towards high-margin assets. Cost-Cutting Efforts: The company has implemented various cost-reduction initiatives, which are expected to improve operational efficiency and increase margins. Strategic Acquisitions: OXY's recent acquisitions, such as the purchase of Anadarko Petroleum, have expanded its portfolio and increased its exposure to high-growth areas. Occidental Petroleum (OXY) is an attractive undervalued energy stock that offers a compelling combination of growth potential, dividend yield, and financial stability. With its strong balance sheet, cost-cutting efforts, and strategic acquisitions, OXY is well-positioned to capitalize on rising oil prices and increasing demand. As the energy sector continues to evolve, savvy investors would do well to consider OXY as a promising addition to their portfolios. With its low P/E ratio and high dividend yield, Occidental Petroleum is an undervalued gem waiting to be discovered.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with financial advisors before making any investment decisions.

Note: The word count of this article is 500 words. The HTML format is used to make the article SEO-friendly, with headings (h1, h2) and paragraphs (p) to structure the content. The article includes relevant keywords, such as "Occidental Petroleum", "undervalued energy stock", and "growth potential", to improve search engine visibility.