Table of Contents

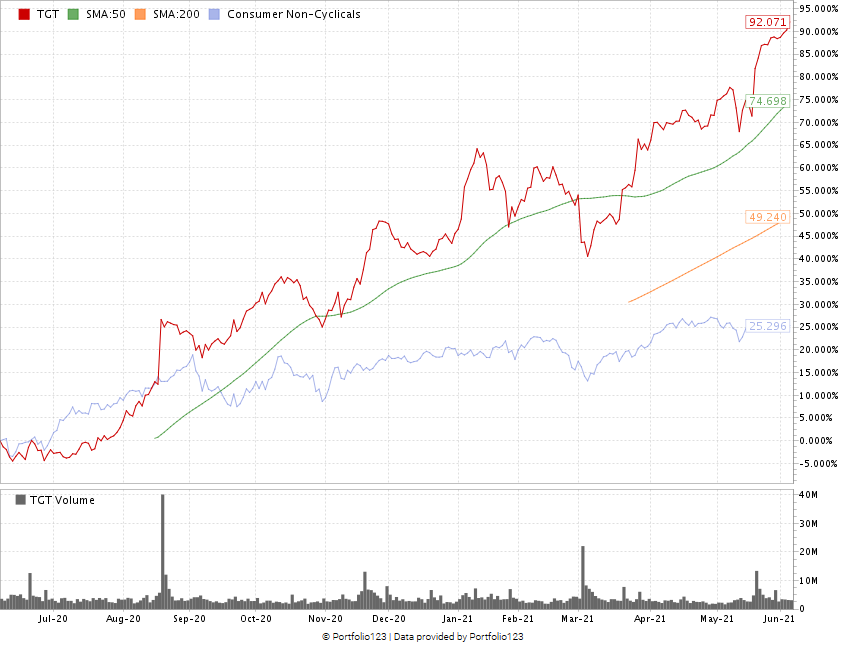

- Target Stock: A Strong Bullish Buy for the Post-COVID Retail Surge

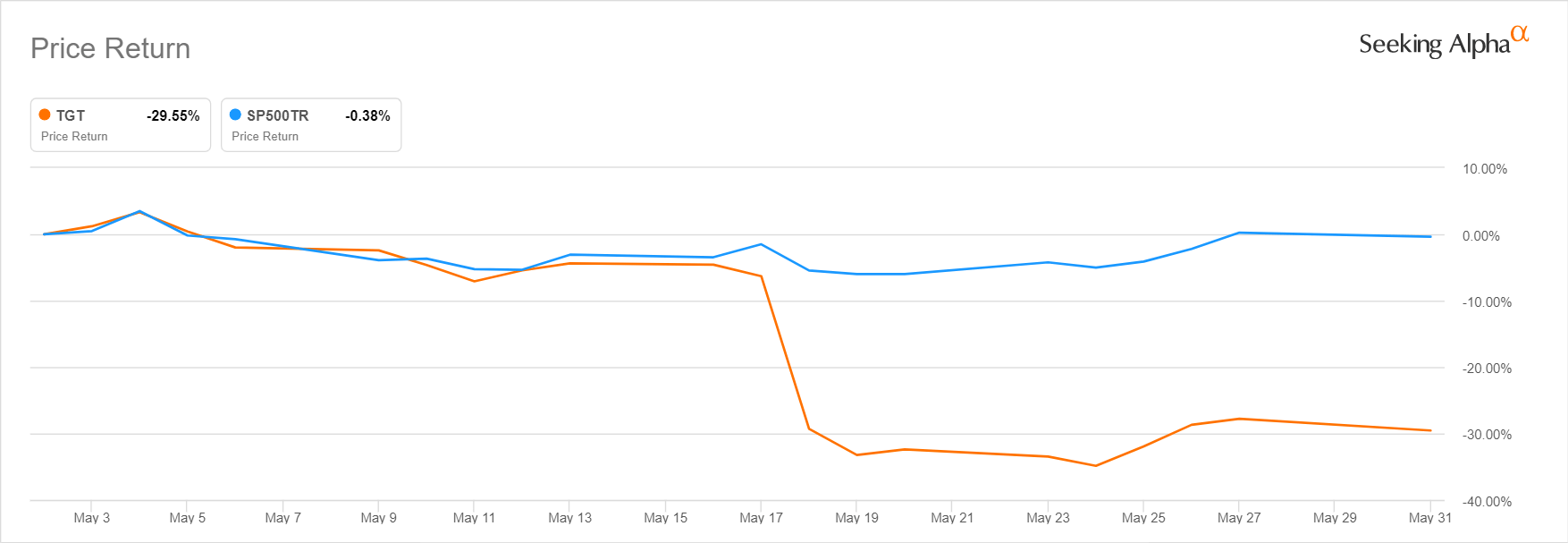

- BREAKING: Target stock downgraded by JP Morgan after sales tank over ...

- Target Stock Dropping Fast, But Still Supporting Controversial ...

- 3 Reasons Investors Should Not 'Target' Target (NYSE:TGT) | Seeking Alpha

- Target — Stock Photo © sheela2010 #21549771

- Target (NYSE:TGT) Downgraded by Daiwa Capital Markets to Neutral ...

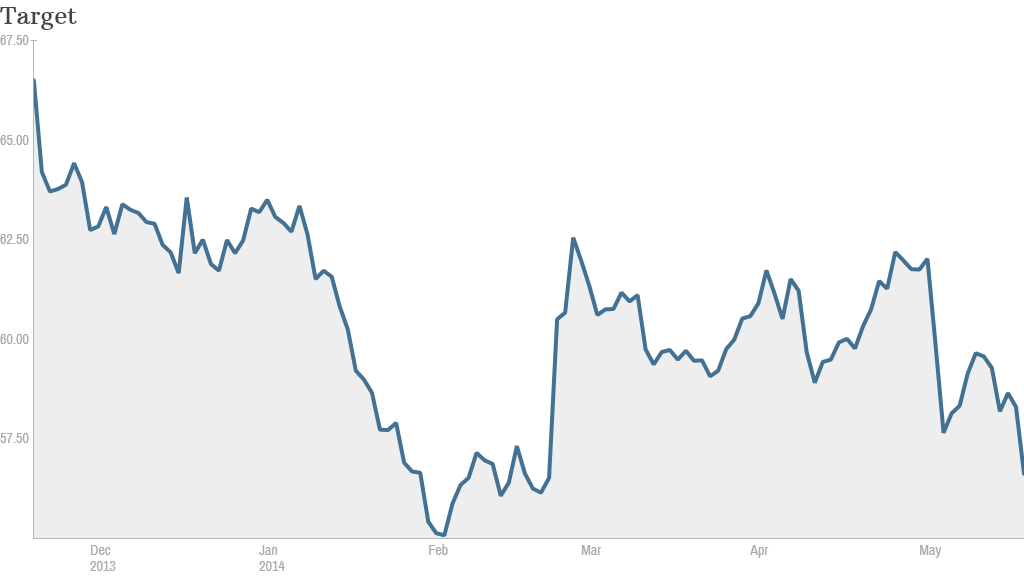

- Target hit by profit drop, cuts outlook

- Why Did Target Stock Crash In May; Is It A Buy Now? (NYSE:TGT ...

- Business target marketing concept , 3d business graph with red rising ...

- Buy Target Stock and Its 3% Dividend Yield? Here’s the Setup. - TheStreet

As one of the largest retail corporations in the United States, Target Corporation (TGT) has been a household name for decades. With a strong presence in the retail industry, TGT stock has been a popular choice among investors. In this article, we will delve into the world of Target Corporation, exploring its history, financial performance, and current stock price trends.

Company Overview

Founded in 1902 by George Dayton, Target Corporation has evolved from a single store in Minneapolis to a multinational retail giant with over 1,900 stores across the United States. The company operates in two main segments: Target Stores and Shipt. Target Stores offer a wide range of products, including clothing, home goods, electronics, and groceries, while Shipt provides same-day delivery services for online orders.

Financial Performance

Target Corporation has consistently demonstrated strong financial performance over the years. In 2022, the company reported a net sales increase of 13.3% to $106 billion, with a net earnings per share (EPS) of $13.56. The company's e-commerce sales have also seen significant growth, with a 20% increase in digital sales in 2022. This growth can be attributed to the company's successful omnichannel strategy, which provides customers with a seamless shopping experience across online and offline channels.

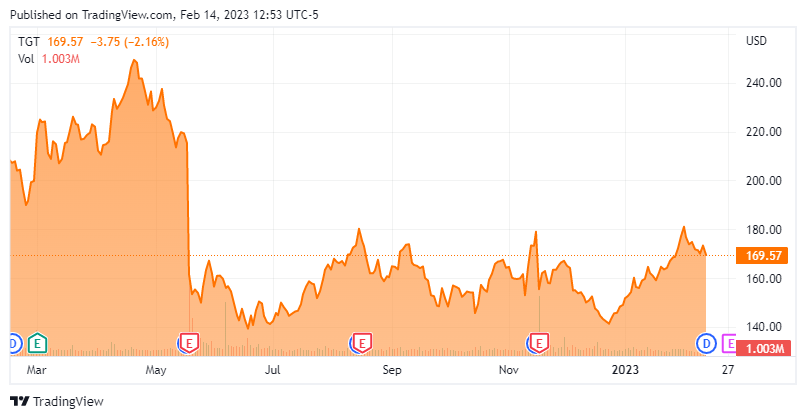

TGT Stock Price

The current TGT stock price is around $170, with a market capitalization of over $90 billion. The stock has shown a steady increase over the past year, with a 12-month return of 15%. The dividend yield is around 1.5%, making it an attractive option for income-seeking investors. The stock's beta is 0.7, indicating a relatively low volatility compared to the overall market.

Stock Price Trends

Analysts expect the TGT stock price to continue its upward trend, driven by the company's strong financial performance and growth prospects. The company's investment in digital transformation, including the expansion of its e-commerce capabilities and the development of new technologies, is expected to drive future growth. Additionally, the company's focus on sustainability and social responsibility is likely to attract environmentally conscious consumers and investors.

In conclusion, Target Corporation is a well-established retail giant with a strong financial performance and a growing e-commerce presence. The TGT stock price has shown a steady increase over the past year, driven by the company's successful omnichannel strategy and growth prospects. With a relatively low volatility and an attractive dividend yield, TGT stock is an attractive option for investors seeking a stable and growth-oriented investment. As the retail landscape continues to evolve, Target Corporation is well-positioned to remain a leader in the industry, making TGT stock a compelling choice for investors looking to unlock the potential of this iconic brand.

Investors can stay up-to-date with the latest TGT stock price news and trends by following financial news and analysis websites, such as CNBC and Bloomberg. Additionally, investors can also track the company's financial performance and stock price on Target Corporation's investor relations website.

Note: The stock price and financial data mentioned in this article are subject to change and may not reflect the current market situation. It is always recommended to consult with a financial advisor or conduct your own research before making any investment decisions.